Loading... Please wait...

Loading... Please wait...Products

- Solar Panel Kits

- Solar Products

- Solar Panels

- Inverters

- Batteries

- Racking and Mounting

- Rails

- Flashings

- Splice Kits

- Stopper Sleeves

- Conduit Mounts

- Attachments

- Brace Assembly

- Base Mount

- Brackets

- Bolts

- Clamps

- Caps

- L-Feet

- Washers

- Skirt

- Lugs

- Tilt Legs

- Hooks

- Stand-Offs

- Ballast Bay

- Top of Pole Mount

- Side of Pole Mount

- Flush Mount Kits

- Ground Mount Kits

- Roof Mount Kits

- Hardware Packages

- Wire Management

- Solar Generators

- Inverter Monitoring

- Inverter Accessories

- Battery Accessories

- Charge Controllers

- Tools and Supplies

- View All Products

Solaris Blog - Michigan Solar Energy

Michigan Solar Energy Incentives

Posted by Brandi Casey on 22nd Jan 2017

The year 2016 was a big year for solar installations. With more residential systems springing up around the country, there is a clear consumer set standard for energy independence using clean energy. Although very northern states such as Michigan do not get as much sun rays as a state like California, there is plenty of opportunity and necessity for homeowners to go solar. Michigan is currently sitting at 12 th place in the nation’s highest electricity costs, and the state does get enough solar irradiance to merit installing a solar system which will generate a high ROI. Michigan has been working hard over the last decade to incentivize homeowners and businesses to install renewable energy sources. Michigan further encourages new photovoltaic technologies by to claim a tax credit against the Michigan Business Tax.

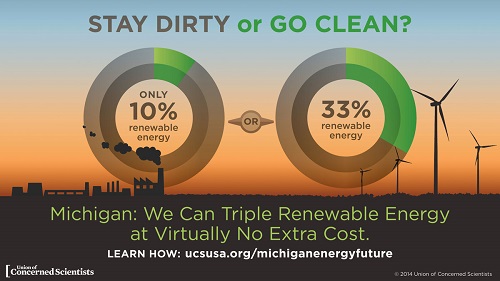

In 2008 Michigan passed the Renewable Energy Standards (RES) in which, all of Michigan’s utility companies are required to source at least ten percent of their total energy from a renewable energy source. Although the law expired in 2016, the debate as to whether the law will be renewed is still underway, and Michigan’s impressive Net Metering laws are still in place. Michigan may further alter the laws for improvement, and those interested in going solar in the state should keep up to date on the growing incentives for solar investment.

Michigan’s Net Metering Regulations

Michigan’s Net Metering Law allows residential photovoltaic system owners to meter systems up to 15 kilowatts in size. Given the fact that many residential systems range between 2-20 kilowatts, the law covers the majority, if not all, residential systems. Using net metering, homeowners can be credited for future energy consumption on a monthly basis over an indefinite period of time. The utility companies further give a generous cap of 20 kilowatts per month, which can accumulate quickly and lead to deep energy savings during the winter months when the sun is not as prevalent and the output of the system generates less energy than the summer months.

For those who which to eventually go off-grid, the utility companies incentivize the break from the utility company by offering reimbursement from excess energy after the homeowner completely disconnects from the grid. After disconnecting, homeowners should call their utility company and request the reimbursement for the excess. Keeping a record of your utility bills, and net metering from your inverter is advised during this time to ensure that their records match the homeowners.

To find out more about Michigan’s Net Metering Laws checkout

the

Michigan Government Website

Further, in 2015, Michigan authorized the first community solar installation, which allows homeowners to purchase half kilowatt blocks and receive credits based on the value of the solar module for the standard 25-year life of the modules. To apply, applicants must sign a standard interconnection agreement with the utility company to ensure eligibility for net metering.

In addition to net metering, Michigan continues to grow

their renewable energy incentives. The list below shows a portion of Michigan’s

ever expanding laws which benefit both home and business owners.

| Grant Programs |

|

| Loan Programs |

|

| Interconnection |

|

| Green Power Purchasing |

|

| Generation Disclosure |

|

| Building Energy Code |

|

| Industry Recruitment / Support |

|

| Rebate Programs |

|

| Property Tax Incentive |

|

| Solar / Wind Contractor Licensing |

|

| Energy Standards for Public Buildings |

|

| Renewables Portfolio Standard |

|

| PACE Financing |

|

| Appliance / Equipment Efficiency Standards |

|

| Net Metering |

|

| Personal Tax Credit |

|

| Corporate Tax Credit |

|

| Feed-In Tariff |

|

| Corporate Tax Exemption |

|